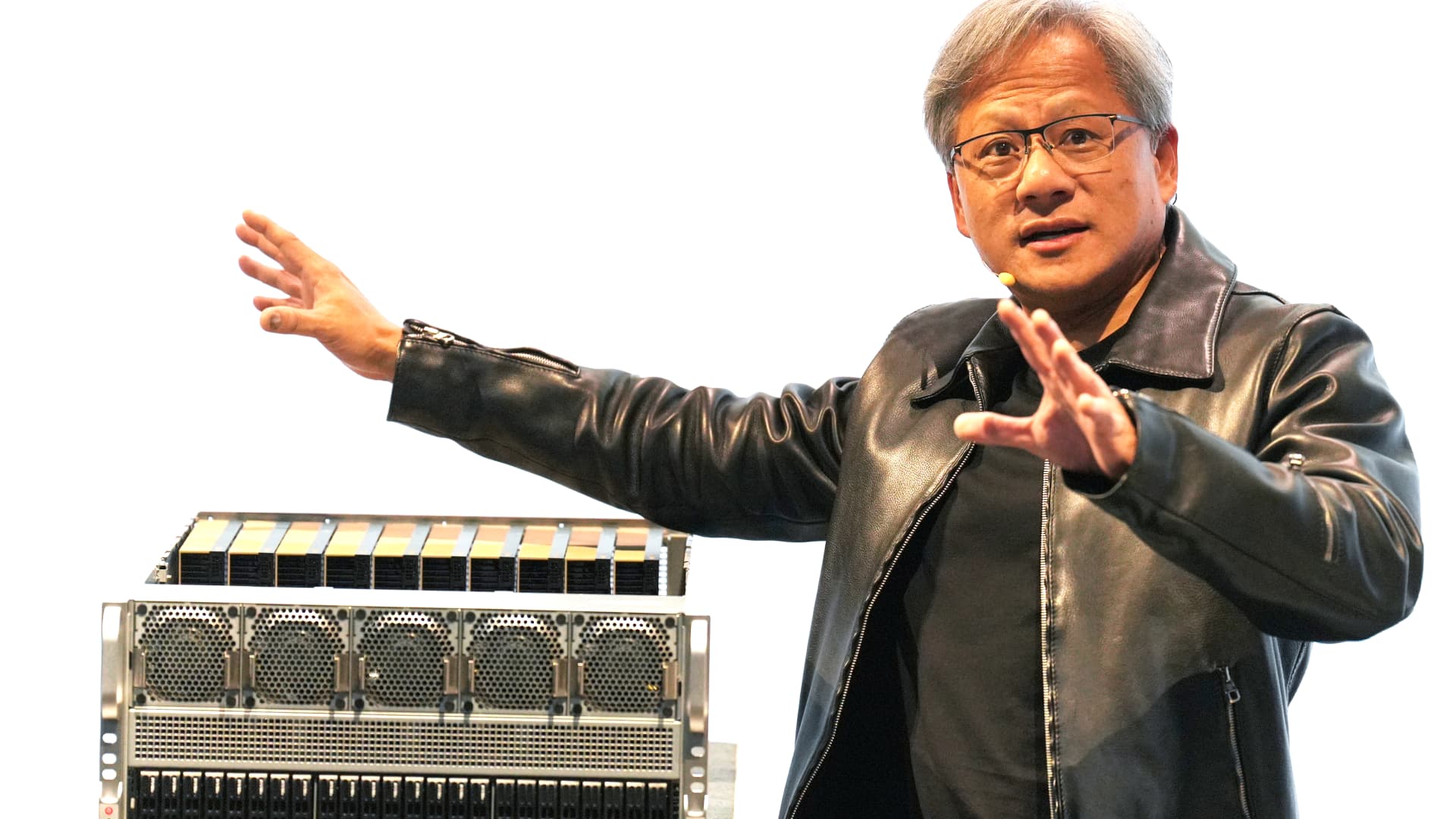

Nvidia CEO Jensen Huang,speaks at the Supermicro keynote presentation during the Computex conference in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Images | Lightrocket | Getty Images

Here’s our Club Mailbag email investingclubmailbag@cnbc.com — so you send your questions directly to Jim Cramer and his team of analysts. We can’t offer personal investing advice. We will only consider more general questions about the investment process or stocks in the portfolio or related industries.

This week’s question: The cardinal rule of discipline is to not violate cost basis and show patience to buy more high-quality stocks on pullback. How do you evaluate a flying stock which might not come back to levels of cost basis to add more? Recent examples include Nvidia (NVDA), Eli Lilly (LLY) and Tesla (TSLA). — Thanks, Ravi

This article was originally published by Cnbc.com. Read the original article here.